CBEX and the Tech-Fueled Rise of Financial Fraud in Nigeria

When CBEX crumbled in Nigeria, it left thousands devastated. But it was just the latest chapter in a growing trend of tech-driven fraud.

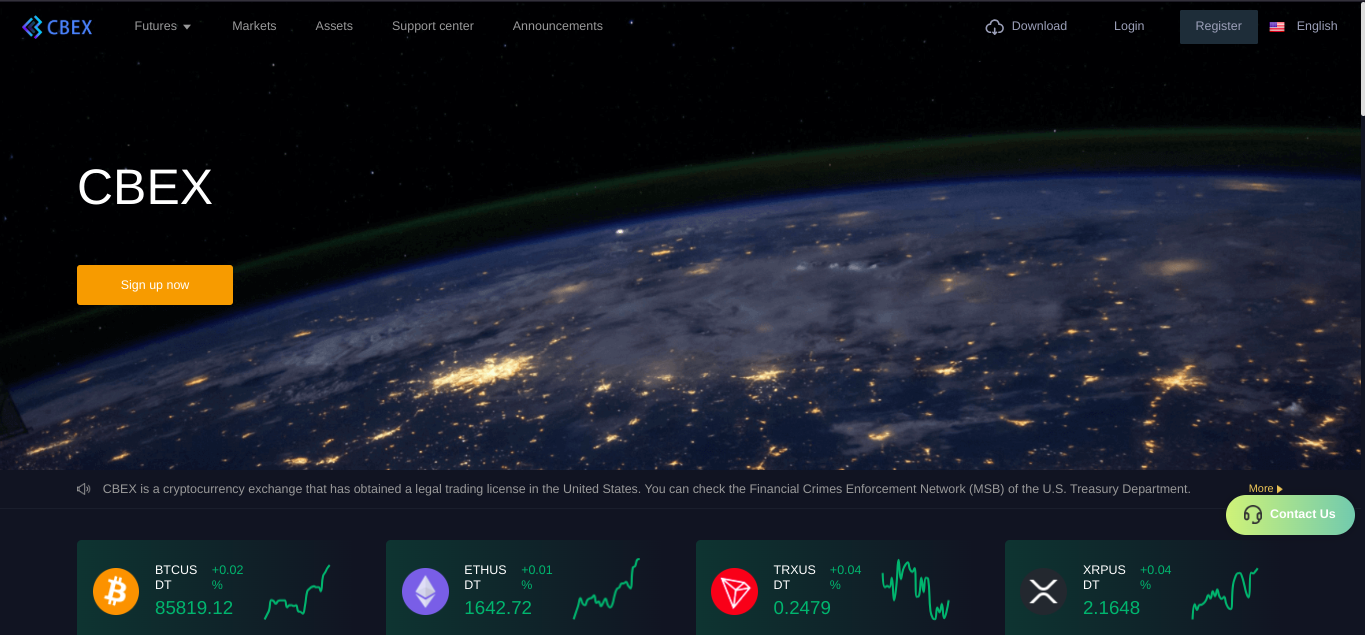

In April 2025, thousands of Nigerians woke up to the cold reality that CBEX, a popular cryptocurrency investment platform, had crashed. Marketed as a game-changing opportunity that promised investors high returns via 'digital trading', CBEX turned out to be just another Ponzi scheme. Quite the familiar nightmare dressed in modern tech buzzwords.

Victims poured out their stories online. Some lost life savings, while others dragged in friends and family who blamed them for their financial ruin. The CBEX collapse follows a worrying trend of financial fraud schemes exploiting the digital divide, the economic desperation of young Nigerians, and a lack of regulation and education around online investments.

In this article, we'll explore how these scams work, some recent examples you should know, and how to protect yourself in the evolving scam economy.

So without further ado, let's explore the world of financial fraud at its finest.

What Are Financial Fraud Schemes?

At their core, financial fraud schemes involve tricking individuals into giving away their money. It often comes with the false promise of returns, rewards, or investment growth. Many are structured to appear legitimate and even operate for weeks or months before vanishing overnight. Let's take a look at some of them:

Ponzi Schemes

Arguably the most notorious financial fraud type, the Ponzi scheme is a deceptive investment model where early investors are paid returns from the money of new investors, but not from any actual profit. These schemes often disguise themselves as legitimate opportunities, promising impressive returns within weeks, days or even hours. But behind the flashy stuff, they’re simply recycling cash until the system inevitably collapses when new money runs out.

The term "Ponzi scheme" originates from Charles Ponzi, an Italian immigrant in the U.S. during the early 20th century. In the post-World War I era, international mail surged in popularity. Ponzi noticed that International Reply Coupons (IRCs) used to prepay return postage had different values across countries. He claimed he could exploit this difference, buying IRCs cheaply in one country and profiting by selling them in another.

To fund this operation, he promised investors massive returns within 45 days. But in reality, there was no sustainable business model. Ponzi used money from new recruits to pay earlier investors. When the flow of new investment dried up, the scheme imploded. By 1920, he was exposed, arrested, and later, deported.

One hundred years later, the scam model hadn’t changed, only the packaging.

In July 2020, Racksterli emerged, spearheaded by Michael Oti. It promised to double your money in 30 days, with bonuses for every successful referral. Unlike many faceless scams, Racksterli had all the bells and whistles of legitimacy: a polished website, a named CEO, celebrity endorsements (including Davido and Rema), and even a sponsorship deal with 'The Nancy Isime Show' on Africa Magic.

It claimed to make profits through real estate, forex trading, and gadget sales. However, the structure was nothing but pure Ponzi. According to reports by the ICIR, users began facing withdrawal issues by March 2021. Soon after, the website went down and the platform disappeared.

But the story didn’t end there.

Michael attempted a quick re-brand under the name Goldomc, which promised the same rewards under a new name. Within weeks, that platform also crashed, leaving thousands of Nigerians out of pocket and out of answers.

Then came CBEX, which collapsed in April 2025. This wasn’t merely a money-doubling scam. It was a tech-empowered fraud that leveraged buzzwords like AI-powered crypto trading, blockchain analysis, and automated wealth systems to fool a more tech-savvy generation.

CBEX spread rapidly through WhatsApp and Telegram groups, with sleek dashboards that showed fake profits, easy referral links, and enticing 'investment packages'. On the surface, everything looked sophisticated and automated. But underneath, it was the same old game: taking new users’ money to pay old ones.

There was no AI, no real crypto trades. Everything was smoke, mirrors, and good code. When withdrawals were 'temporarily paused' and support chats went silent, the scam fully unravelled, leaving thousands of Nigerians burnt once again by the illusion of financial freedom through tech.

Multi-Level Marketing (MLM) & Referral Schemes

At first glance, pyramid schemes may look like multi-level marketing (MLM). Both are a referral-based system where participants recruit others to buy into a product or service. On the surface, it appears structured: you sign up, promote the “product,” and earn commissions not only from your sales, but from those made by the people you recruit. The deeper your tree, the higher your profits, supposedly.

Here’s where it gets dangerous: most pyramid schemes don’t actually care about the product. In fact, in many cases, there's no real product at all. The entire system survives by funnelling money upwards from new recruits, not from real external sales or value creation. According to the Consumer Awareness Institute, over 99% of people involved in such schemes ultimately lose their money. Still, because of the massive profits made by those at the top, along with the illusion of success, pyramid structures remain popular among shady operators.

While legitimate MLMs may offer tangible products and rely on external revenue, pyramid schemes emphasise recruitment over value, using layers of human capital like scaffolding, which is ready to collapse once no one else joins.

In Nigeria, pyramid schemes found fertile ground with the aid of tech platforms, mobile accessibility, and social media virality.

Take the Twinkas scheme that ran from 2016 until late 2023. Launched shortly after the crash of the infamous MMM, Twinkas claimed to be an “electronic marketplace", leveraging e-commerce language to obscure its structure. The platform offered double-your-money-style “investments” and promised returns through member-to-member donations. Its interface, now defunct but still archived on the Wayback Machine, once spoke of secure digital trading and mutually beneficial commerce.

Ironically, it suffered repeated Trojan Horse attacks, database losses, and eventually fell into a spiral of shutdowns and unfulfilled payouts. Oddly enough, its disclaimer clarified:

'Twinkas is not a financial institution'.

Quite a bold statement for a platform supposed to handle thousands of digital transactions.

While we're no scammers, we need your help to keep GlitchArc afloat. Subscribe to our monthly newsletter or join our store waitlist to get a special discount once we go live!

Advanced Fee Fraud (a.k.a. 419 Scams)

It’s called 'Advanced Fee Fraud', but don’t let the name fool you. It’s one of the oldest and simplest tricks in the book. The scam works like this: a fraudster reaches out via email, text, or even LinkedIn, claiming to be in urgent need of your help. In return for your kindness now (usually in the form of a small payment), they promise you a much larger reward: an inheritance, investment, job offer, or international fortune. Once you send the money, they vanish without a trace.

The most famous version? The classic 'Nigerian Prince' scam, where a supposed royal or official offers you millions if you just help them move funds offshore. But the original intent wasn’t always direct cash. It was usually to get sensitive financial details that could be used to access bank accounts for a bigger heist.

Before the internet, the scammers relied on actual physical letters, risking money and effort on each attempt. But the digital age changed everything.

The Internet brought the cost of communication down to virtually zero. What once cost stamps and paper now only takes a free email or a bot on WhatsApp. Mass messaging, automated scripts, and phishing kits allow a single scammer to reach thousands daily with almost no overhead costs.

Add AI into the mix, and you get pristine, polished, grammatically correct messages, personalised greetings, and fewer red flags that used to give these scams away. Today’s emails don’t just ask for help. They look like official correspondence from banks, embassies, and HR departments.

To fight back, email platforms created spam folders and filters, but some messages still slip through, especially as fraudsters learn how to evade detection. A well-crafted subject line or a realistic company name can be enough to lure someone in.

Let's take a real-world example. You get a message on LinkedIn, email, or Telegram offering a high-paying remote role or scholarship opportunity. The only catch? A small 'onboarding', 'training', or 'processing' fee. Once paid, the company will ghost you. No job and no grant. Just another victim in a scam that has adapted to modern tech tools.

Pump-and-Dump Schemes

If you’ve seen The Wolf of Wall Street, you already have a taste of how pump-and-dump schemes work. But while the con might be old, its new digital face is faster, flashier, and a bit harder to trace.

In a typical pump-and-dump, bad actors pick a cheap, low-liquidity asset like a penny stock or obscure crypto coin. They quietly buy in, then begin to pump up the value by hyping it to unsuspecting investors. Once the price rises due to the artificial buzz, they dump their holdings, cashing out while everyone else watches the value collapse.

Back in the day, cold calling was the weapon of choice. Fraudsters dialled up potential investors, pushing 'hot tips' on sketchy stocks. Today, that tactic has migrated to encrypted messaging platforms and social media. With just a few clicks, scammers now organise thousands into synchronised pump campaigns, often with more precision than the traditional stock market itself.

According to an Investopedia, Telegram and Discord are prime hunting grounds for pump-and-dump groups. Entire channels exist solely for this purpose. Users are lured in with promises of insider access or quick returns. Once inside, they wait for the signal: a pump call that sets the whole plan into motion.

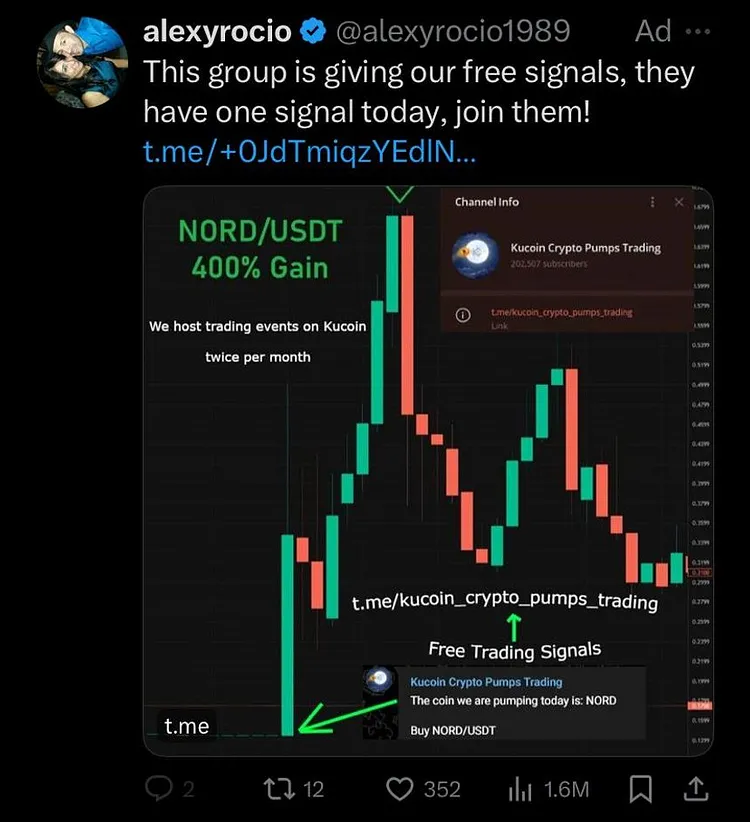

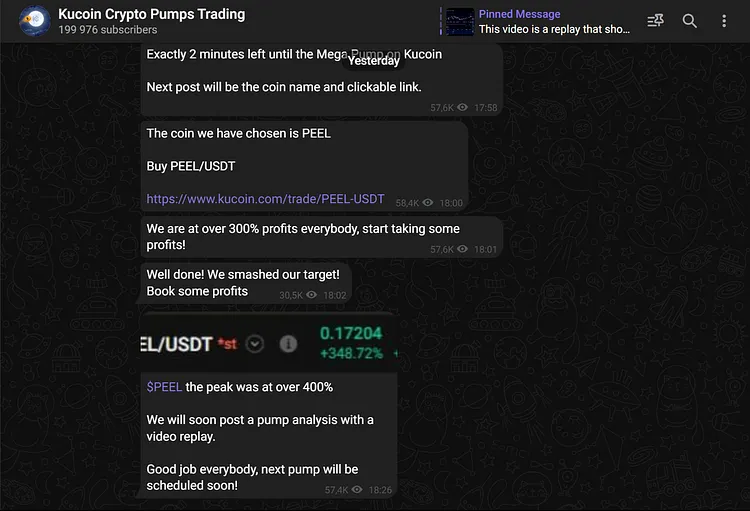

Back in 2023, I conducted some research into one of these groups to see how it played out in real time, ’cause... why not?

I joined a Telegram pump group I’d found advertised on X. It was scheduled just like an event, complete with a countdown and hype messages to get people ready.

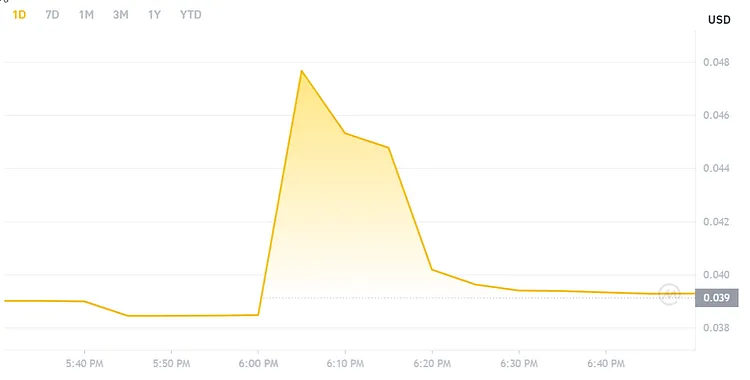

At exactly 6:00 PM WAT, the signal dropped: buy $PEEL. Within two minutes, the token’s price spiked sharply and a good chunk was gone by 6:10 PM.

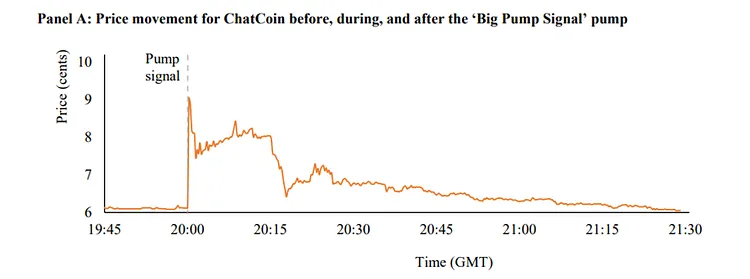

By 6:20 PM, the value had collapsed. The price chart on Binance showed a steep peak and fall, typical of a pump-and-dump.

The most interesting part? The entire operation ran like a lean, mean, money-scamming machine. Unlike traditional scams, tech enabled anonymous coordination across thousands of users, rapid execution on crypto exchanges, and near-instant communication via messaging apps.

This wasn’t a one-off either.

While researching for this article, I found this paper which referenced Chatcoin, which was pumped and dumped in less than two minutes.

What makes these schemes particularly dangerous today is their accessibility and speed. With a Telegram account and a few dollars in crypto, almost anyone can get involved. And once the hype engine starts rolling, boosted by bots, or even algorithmic trading, it’s hard to stop.

Coaching & Mentorship Scams

Among the most deceptive types of financial frauds are coaching schemes. It is a newer and more subtle breed of scam that preys on your desire for self-improvement or financial success. These scams involve paying individuals or organisations significant sums of money to learn a skill, start a business, or gain access to 'proven' strategies that either don’t work, aren’t practical, or simply don’t exist.

Before the digital boom, coaching scams thrived on late-night infomercials and televised get-rich-quick pitches. In fact, the U.S. Federal Trade Commission (FTC) took several of these shows to court in 2012 for misleading viewers. But the digital age has made things worse.

With the rise of online courses, digital ads, and automated payment systems, coaching scams now reach wider audiences with polished branding and persuasive marketing. Tech platforms like Google Ads, YouTube, and even national newspapers have unintentionally (and sometimes intentionally) become enablers, allowing scammers to build false credibility with slick websites and paid media placements.

A perfect example is DollarsPathway[.]com, a site that claims to offer premium online courses in cybersecurity, digital marketing, and data science with 'guaranteed' success outcomes. But upon closer inspection, the red flags are everywhere:

- The 'About Us' page makes grand promises, yet no actual experts or verifiable individuals are listed.

- Every course is hidden behind a paywall. You can’t even view a syllabus without paying.

- Prices go up to ₦212,500 (about $130+) for vague training with no credentials or refund guarantees.

- The biggest shock? Mainstream news outlets like Punch and The Nation have featured the scam on their websites as “breaking news,” adding a false layer of legitimacy and social proof.

Tech has helped coaching fraud evolve. Scammers can rent virtual offices, build fake testimonials, run automated email campaigns, and spread sponsored content across legitimate platforms, making it hard for the average user to distinguish scam from skill.

Here are a few flags to watch out for when it comes to coaching schemes:

- 'Limited-time' discounts designed to rush you into payment

- A lone 'guru' selling a rags-to-riches story

- Anonymous testimonials or unverifiable success stories

- Promises of fast, easy money with no clear roadmap

- Paywalls hiding actual content (no previews or transparency)

- Buzzwords with little substance: 'AI millionaire', 'secret investment method', 'passive income cheat codes'

Unlike more obvious scams, coaching fraud is slippery. It wears the costume of education and self-help, making victims feel like their failure is personal rather than systemic. This makes it even harder for the individual to report to authorities, much less file a lawsuit.

Gamified Tapping & Fake Airdrop Apps

Thanks to the age of mobile gaming and cryptocurrency, this new one emerged. These platforms often disguise themselves as play-to-earn games, where users are promised future crypto payouts in exchange for repetitive actions like tapping, upgrading digital assets, or referring friends.

At first glance, they seem harmless and even fun. But underneath the hood, they’re often elaborate data farming or engagement manipulation schemes, designed to create viral hype while offering little or no real financial value.

One of the most talked-about cases in Nigeria and globally was Hamster Kombat, a Telegram-based game that rewarded users for 'tapping' and referring others. The platform claimed users would earn crypto rewards once it officially launched a token. For months, users engaged daily, even forming referral pyramids and community groups to maximize their points.

When the payout phase eventually came, many hopefuls were nothing short of perplexed. Their efforts amounted to just a few dollars or less in value. Despite millions of hours collectively invested, the final outcome resembled a digital mirage, where users were chasing a pot of gold that never really existed.

Prior to Hamster Kombat, Pi Network was one of the earliest and most well-known players in the tapping-to-earn space. Launched in 2019, it promised users free cryptocurrency for simply logging into the app daily and pressing a button. Users were encouraged to refer others to grow their “mining rate”.

Years later, despite gaining millions of users, there was still no clear token launch, utility, or liquidity for Pi. Many users began to question whether their years of digital mining had any real-world value. To date, the Pi token has had limited or no official public listing on major exchanges.

The success of these apps lies in their clever use of gamification, social sharing, and psychological rewards (points, upgrades, and leaderboards). They exploit Telegram bots, app notifications, and influencer marketing to build hype and keep users locked in for months, if not years. Their payout models, if they exist at all, are vague, delayed, and usually underwhelming.

How to Protect Yourself from Scams

From pyramid schemes and pump-and-dump cons, to fake coaching platforms and gamified tapping apps, today’s financial fraudsters have more tools than ever before. They have slick websites, viral Telegram bots, and are even 'influencer-backed'. But no matter how sophisticated these schemes become, the principles that protect you remain the same.

Here's how to stay safe, sceptical, and secure:

1. The ROI Rule: If It Sounds Too Good to Be True, It Is 📉

A classic rule of thumb that still applies in 2025:

Never trust a platform that promises outrageous returns in a matter of days or weeks.

Legitimate investments such as mutual funds, real estate, or global stocks usually return 8% to 15% per annum, not 100% in 5 days. If someone tells you to 'just invest ₦100,000 and watch it turn into ₦500,000 next week', what they’re offering isn’t an opportunity, but armed robbery.

Modern scams use buzzwords like 'AI-powered', 'crypto leverage', 'DeFi yield farming', or 'exclusive airdrop access'. But strip away the jargon and ask:

Where’s the product? Who’s buying it? Why is it profitable?

If you can't answer those clearly, you have no business putting your money in it.

2. Understand What You're Getting Into 🧠

Every real business needs:

- Capital (money or resources)

- A Product or Service (what is given in exchange), and

- A Market (someone who needs it)

If a venture lacks one of these, or worse, hides them behind vague marketing terms, it’s likely a scam. For example, tapping apps like Hamster Kombat never clearly explained what they actually produced or how revenue would be generated. Unsurprisingly, most users got nothing but 'points'.

Before putting your money into anything:

- Do a Google search on the company and its founders.

- Check LinkedIn for actual employee profiles.

- Look for transparent financials, and read independent reviews (not testimonials on their own website or Telegram channel).

3. Avoid Faceless (or One-Faced) Operations 👥

If there’s no real leadership or only one guru running the show, be wary. Even the best online businesses are built by teams having developers, marketers, legal officers, and customer support.

Scams like Racksterli and DollarsPathway often had only one face or none at all, with unverifiable names and addresses. If a company’s 'About Page' can’t tell you who is behind it, or you can’t trace any of its team members to a real digital footprint, you should assume the worst.

On the flip side, reputable companies and online course platforms (like Coursera, TryHackMe, or HTB) showcase their instructors, accreditations, and learning partners.

4. Don’t Trust Social Proof Blindly 📲

Tech makes it dangerously easy to fake credibility. Scammers easily:

- Buy fake reviews and testimonials

- Fabricate news coverage using deceptive ads on popular websites

- Create Telegram/Discord hype groups filled with bots

- Use stolen pictures for 'success stories'

If you're reading a glowing review or seeing 'breaking news' about a new app or investment on a site like Punch.ng or YouTube, double-check the source. Better yet, search for scam complaints or user experiences with the platform before engaging.

5. Be Patient. Be Curious. Be Educated. 📚

The research paper, 'Factors Influencing Ponzi Scheme Participation in Nigeria', found that poor economic conditions, greed, and referrals were major reasons why Nigerians fall for Ponzi schemes time and time again. If you want to build lasting wealth, skip the shortcuts and take the high road. Here’s how:

- Read books on personal finance and investing.

- Learn real skills (coding, writing, design, etc.) from credible platforms.

- Consider safe, long-term investments like index funds.

- Track your income, spend wisely, and build gradually.

Remember, even if money grew on trees, you’d still need patience, water, and sunlight to grow one 🌱.

Final Thoughts

The Internet has made it easier to learn, earn, and connect. However, it’s also made fraud scalable and more believable. Tech is just a tool. It can either empower you or exploit you. The difference lies in how informed you are.

So, before you click, tap, invest, or share, take a pause. Ask questions, verify claims, and most importantly, never stop learning. See you in the next one 👋.

Cover Image by Nataliya Vaitkevich.